Life insurance is an essential component of any family's financial plan. It provides peace of mind and financial security in the event of an unexpected death. However, determining how much life insurance a person or family needs can be a challenge. There are several factors to consider when determining the appropriate coverage level.

The first factor to consider is the individual's income. A general rule of thumb is to purchase life insurance coverage equal to 10 to 12 times your annual income. For example, if your annual income is $50,000, your life insurance policy should provide coverage of $500,000 to $600,000.

Another factor to consider is any outstanding debts or financial obligations. This can include mortgage payments, car loans, credit card debt, and other expenses. It's important to consider how much money would be required to pay off these debts and ensure that your family can maintain their standard of living.

In addition, it's important to consider any future expenses, such as college tuition for children or ongoing medical expenses for a spouse. These expenses can be significant, and it's important to ensure that your life insurance policy provides enough coverage to meet these needs.

Finally, it's important to consider the length of time that you will need coverage. For example, if you have young children, you may want to ensure that your life insurance policy provides coverage until they are adults and financially independent.

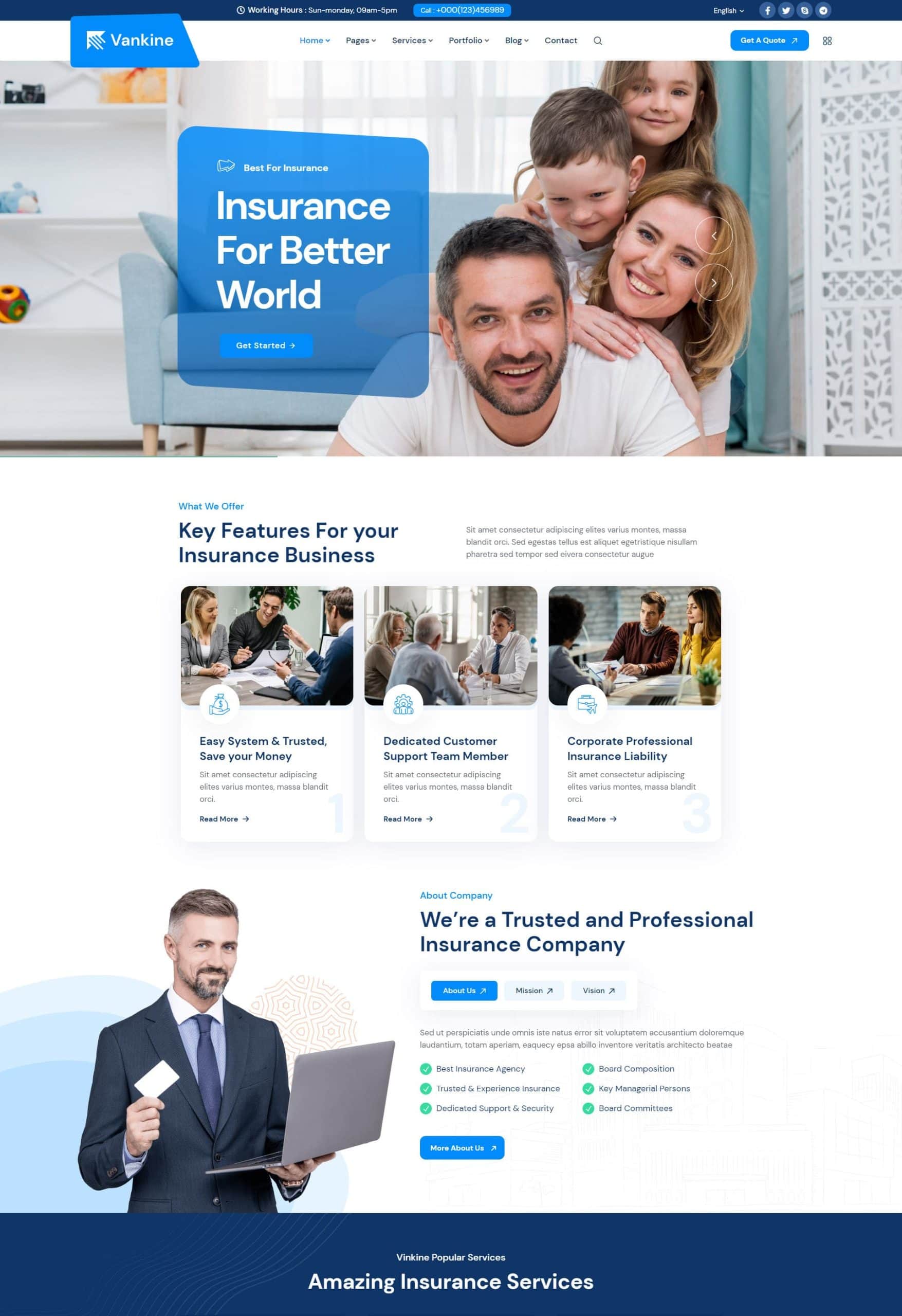

At our agency, we understand the importance of adequate life insurance coverage and work with each of our clients to determine the appropriate coverage level based on their unique needs and circumstances. We offer a range of life insurance policies, including term life insurance, whole life insurance, and universal life insurance, to provide our clients with flexible and affordable coverage options.

If you are unsure how much life insurance coverage you need or are interested in exploring your options for life insurance, contact our agency today to schedule a consultation. We are committed to helping our clients protect their loved ones and achieve financial security for the future.

Français

Français